We often hear from active fund managers that we’re entering a period when stockpickers will shine. We rarely hear them admit that their prospects look bleak. But, as ANU GANTI from S&P Dow Jones Indices explains, there are several technical reasons why active managers really have their work cut out over the next few months.

Active managers’ performance was disappointing in 2020, despite the market’s heightened volatility. As the market continues to march upward in 2021, it’s natural to wonder if current conditions are favorable for stock pickers. We expect active managers’ difficulties to persist.

We can think of volatility in terms of its components: dispersion and correlation. Active managers should prefer above-average dispersion, because stock selection skill is worth more when dispersion is high. At the same time, the price of an active strategy — in terms of incremental volatility — will be relatively small when correlations are high. Both correlation and dispersion are currently below average, as we see in Exhibit 1, indicating relatively inauspicious conditions for active managers.

As a result, the required incremental return for large-cap active managers has risen as correlations have declined, which means they are giving up a greater diversification benefit. Meanwhile, lower dispersion makes it harder to add value. We see similar results for smaller-cap active managers, signalling a relatively more challenging environment for active management.

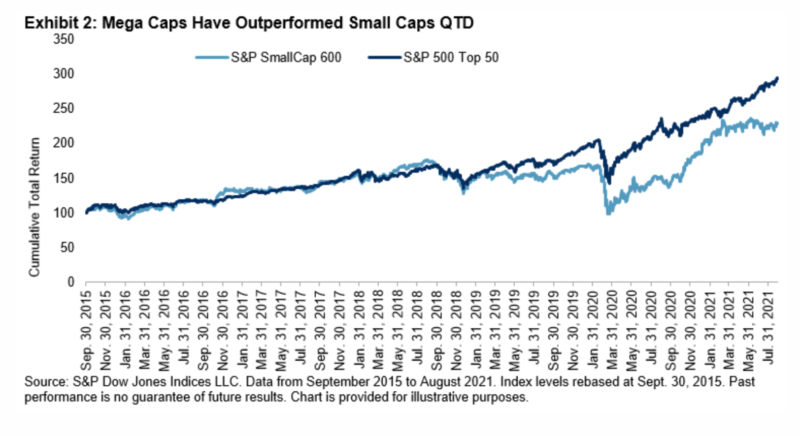

Large-cap active managers face an additional style bias hurdle. Most active portfolios are closer to equal than cap weighted, which means that they have an advantage when smaller stocks outperform. Unfortunately, Exhibit 2 shows that the largest names have recently been performance leaders.

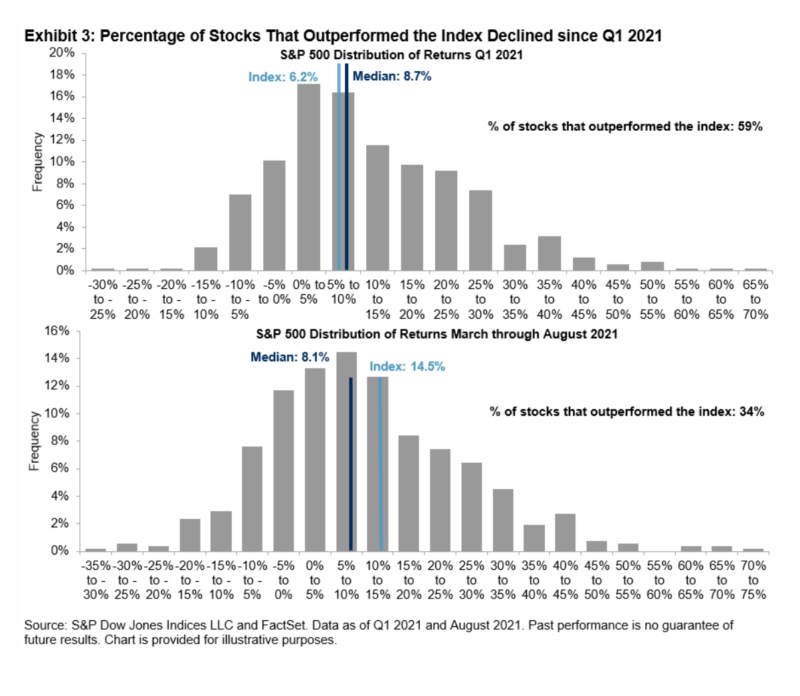

The dominance of mega caps also hinders stock selection, as illustrated in Exhibit 3. In the first quarter of 2021, 59% of S&P 500 members beat the index, when smaller-caps were outperforming. Since then, the tide has turned, and only 34% of stocks outperformed the index, as mega caps outperformed during this period.

The current bleak environment does not bode well for active managers. We recall that 2020 was characterised by relatively favourable conditions for stock selection, and most active managers still underperformed, proving that genuine stock selection skill is rare. If these trends continue, when SPIVA results for 2021 become available, it would not be surprising if we saw lacklustre active management performance once again.

ANU GANTI is Senior Director, Index Investment Strategy, at S&P Dow Jones Indices.

This article was first published on the Indexology blog.

MORE FROM S&PDJI

For more valuable insights from our friends at S&P Dow Jones Indices, you might like to read these other recent articles:

The index effect: how serious is it?

Indexing has saved Americans $357 billion since 1996

Has size contributed to value’s recent revival?

What does history tell us about the value rally?

The case for tracking the venerable Dow Jones

A diverse portfolio is a strong portfolio

PREVIOUSLY ON TEBI

What does salience theory tell us about stock returns?

Why do councils waste so much money on pensions?

Do institutional asset managers possess skill?

Don’t let your investments go the way of the CD

Reviewers wanted for Robin Powell’s new book

Leveraged ETFs: another product for the junk pile

Picture: Aditya Vyas via Unsplash

© The Evidence-Based Investor MMXXI