Do historic bear markets tell us anything about this one?

- Robin Powell

- Jan 10, 2023

- 2 min read

Updated: Nov 6, 2024

2022 was a bad year for equity investors. At one stage the S&P 500 was down 25%. Since then we've seen a recovery of sorts, which begs the question, when will the next bull market start? Indeed, has it started already? AS TEBI readers know, it's extremely hard to call the top or bottom of the market. But what, if anything, does history tell us about where we are now? SHERIFA ISSIFU from S&P Dow Jones Indices has been looking at historic bear markets to see if there are any glimmers of hope among last year's gloom.

“Never sell the bear’s skin before one has killed the beast.”

Jean de La Fontaine

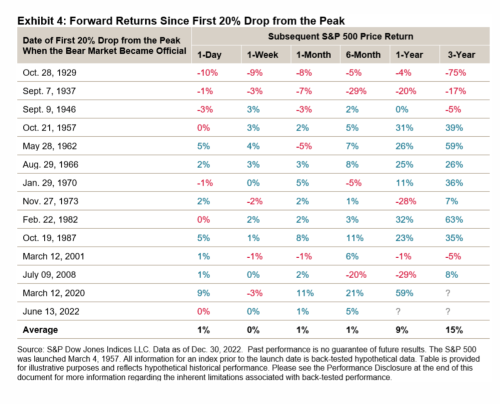

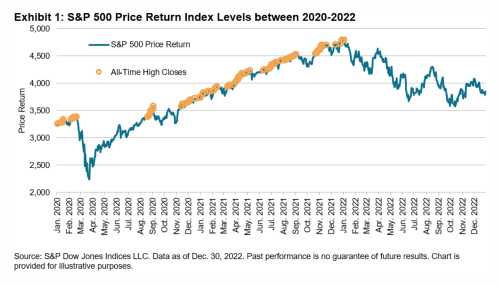

A tumultuous 2022 resulted in the S&P 500 entering a bear market and posting its worst calendar year performance since 2008, down 18%, bringing an end to its three-year winning streak. The picture could have been grimmer had it not been for an early rally in October and November; the S&P 500 was down more than 25% at its worst point. Exhibit 1 shows that the S&P 500’s reached only one all-time high during 2022 (on Jan. 3), the fewest all-time highs in a year since 2012.

Investors may be forgiven for forgetting what it feels like to be in a bear market. The S&P 500’s longest bull market, which began after 2008’s Global Financial Crisis (GFC), was followed by the shortest bear market in history.

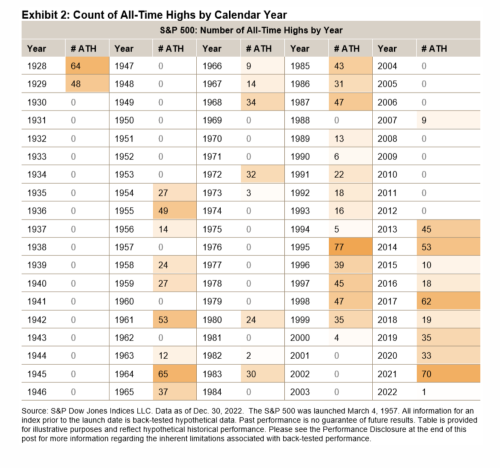

Exhibit 3 shows that the current 2022-23 bear market’s 20% decline hasn’t reached the same magnitude as the 2020 COVID-19 sell-off or 2008 GFC, which recorded declines of 34% and 57%, respectively. However, 2022’s bear market is already 11 times the length of 2020’s COVID correction.

Overall, the S&P 500’s 14 bear markets since 1928 lasted an average of 19 months and were accompanied by an average peak-to-trough performance of -38% (see Exhibit 3).

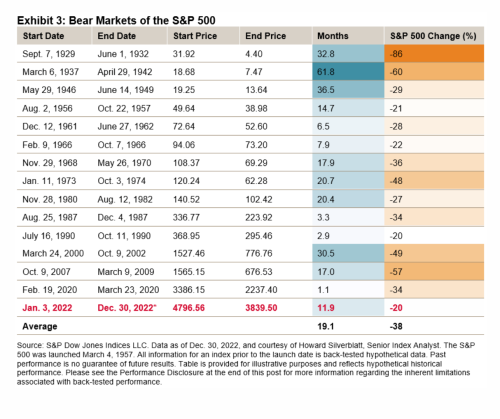

However, market participants can take one silver lining from historic bear markets — the S&P 500 has typically rebounded from major drops over medium horizons. For example, Exhibit 4 shows that the S&P 500 gained an average of 15% over the three-year period following the beginning of a bear market, and the index typically exhibited a positive return.

While history shows the importance of treading with caution in bear markets, a friendly reminder is that at the end of every bear market, a bull market begins and all things pass in time.