The case for looking beyond the S&P 500

- Robin Powell

- Apr 23, 2021

- 2 min read

Updated: Nov 26, 2024

Many investors confine their US exposure to the S&P 500. In doing so, they may be missing out on the long-term outperformance of smaller companies, as Dr TIM EDWARDS from S&P Dow Jones Indices explains.

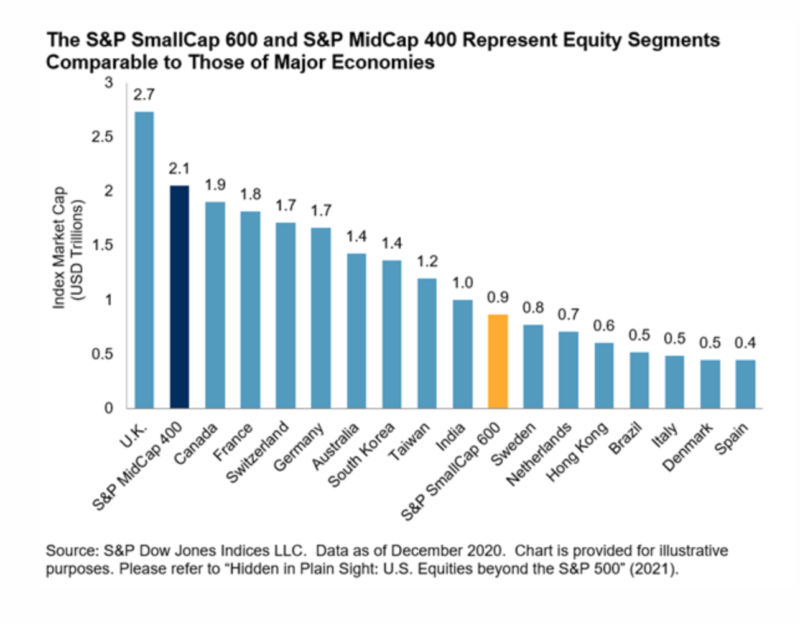

International equity investors have long participated in the U.S. market, but their interest has often focused on the globally recognised blue chips included in benchmarks such as the Dow® and the S&P 500®. In doing so, they may be missing out on the long-term outperformance of smaller companies; presently, they may also be missing out on a diversification and growth opportunity that is “hidden in plain sight” within the global equity landscape. The reluctance of international investors to venture down the capitalisation scale may be due to concerns over the liquidity of smaller names, or potentially to a perception that smaller-stock allocations required active management (with the disappointing performance that active management often entails). But with low-cost, tradeable products tracking indices like the S&P MidCap 400 and the S&P SmallCap 600 being made available internationally, the opportunity set is changing. In a new paper, we examine the international case for exploring beyond the S&P 500 in U.S. equities. As well as arguing that they can provide diversification, particularly when large-cap concentrations are at relatively high levels, we also argue that the U.S. small- and mid-cap segments may be poised to benefit most from an expected surge in U.S. GDP growth. Of course you should read the full paper here; to whet your appetite, here are our top three takeaways and charts: 1. U.S. small and mid caps are a significant part of the global equity market, larger in size than France and most major European nations.

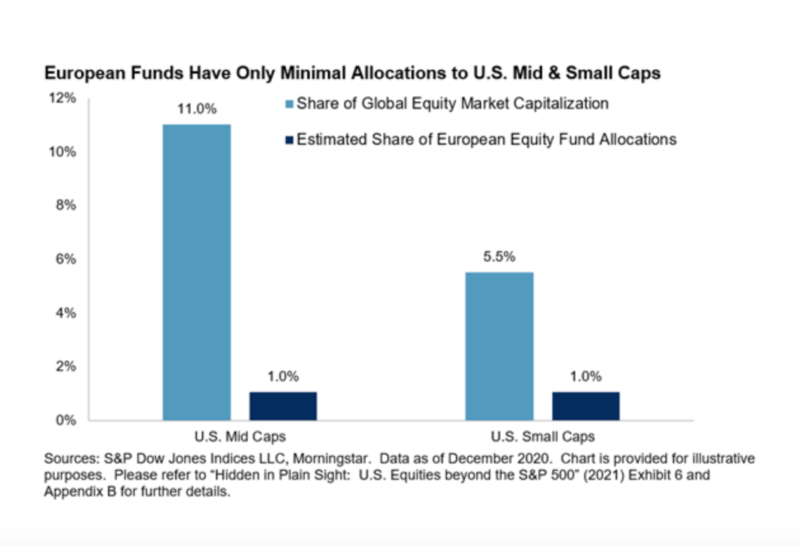

2. European fund investors have so far made only minimal allocations to smaller U.S. companies, particularly when compared to their weight in the global markets, or when compared to U.S. large cap allocations.

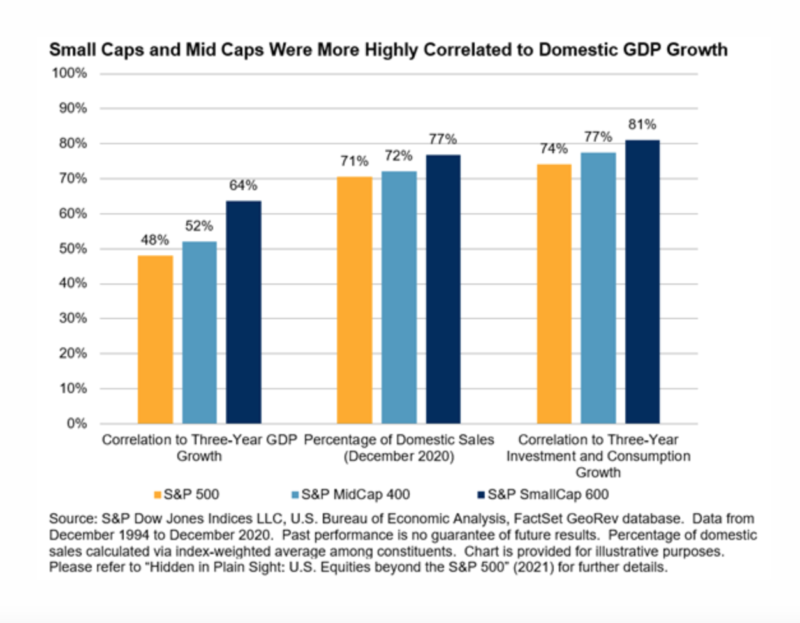

3. Historically, companies further down the capitalisation scale have tracked trends in U.S. GDP more closely than their large-cap counterparts. And while the largest American companies outperformed in the latter part of the 2010s, it left U.S. large caps relatively concentrated in a few large, internationally focused names. It’s no coincidence that a return to strong growth expectations for the domestic economy has seen small and mid caps begin their comeback.

For those based in the U.S., the lack of international demand for small and mid caps could imply a structural price discount; for those outside, this may also represent an opportunity to access a return stream largely ignored by their peers. With the growth in liquid, low-cost, index-based products, market participants worldwide are offered new options for broad-based access to a major source of potential diversification and growth.

Picture: Luke Michael via Unsplash

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited